missouri gas tax refund

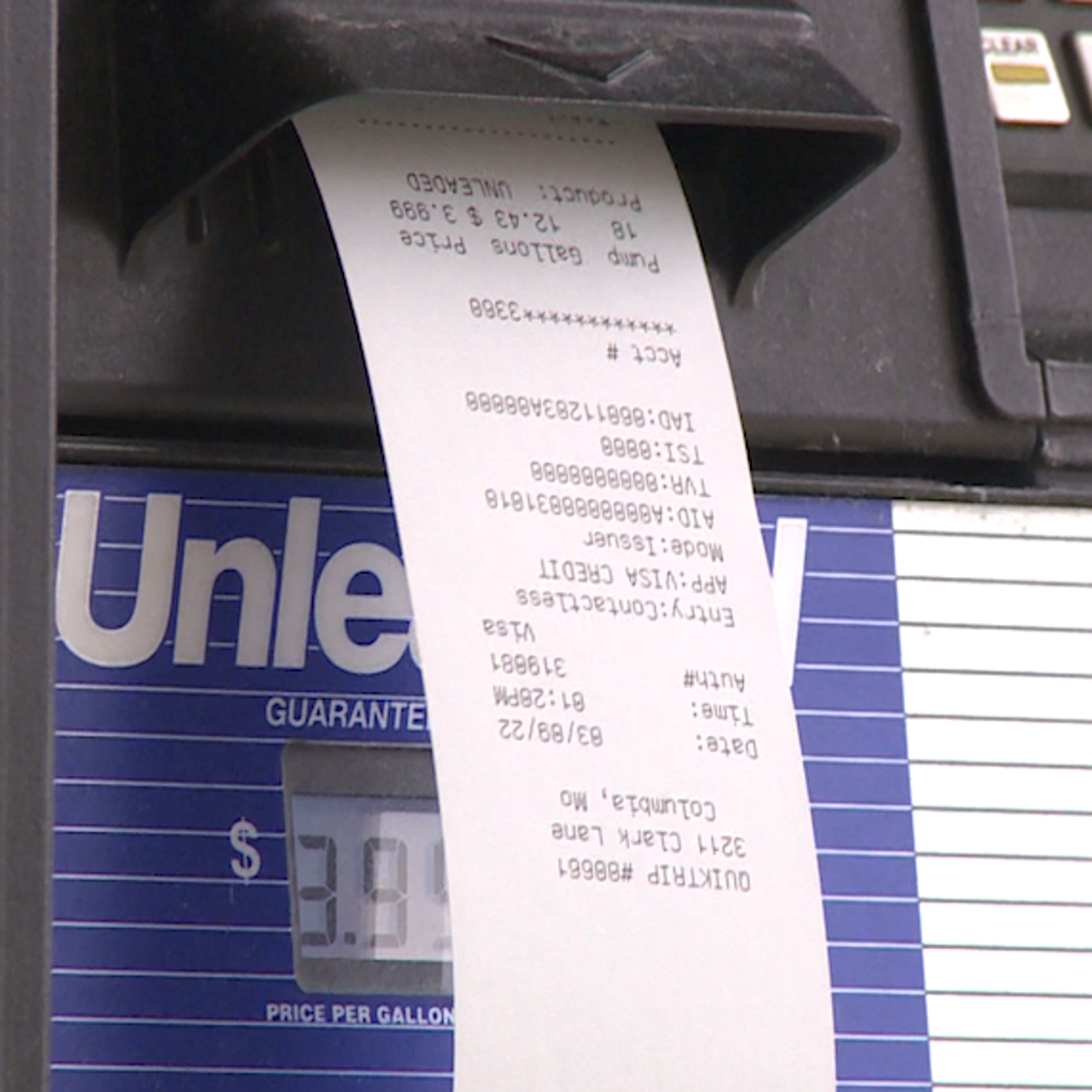

Seller number of gallons purchased and price per gallon Missouri fuel tax and sales tax if applicable as separate items. By then the total gas tax including the hikes will be 295 cents per gallon.

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

Vehicle for highway use.

. Under Ruths plan the gas tax would rise by two cents per gallon on Jan. 1 2022 and will then. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct.

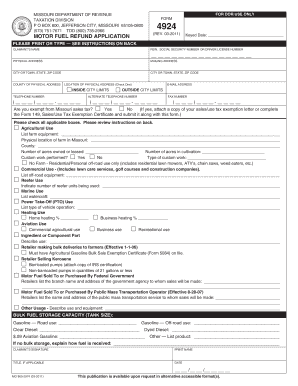

Form 4924 Motor Fuel Tax Refund Application must be on file with the Department in order to process this claim. The bill increases the states fuel tax by 25 cents every year refundable to most Missouri drivers. It was the first gas tax hike in 25 years but it will keep increasing by 25 cents per gallon every year until 2025 according to Missouri Department of Revenue.

The bill includes a refund program for highway vehicles. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. Missouri resident Michael Cromwell said the increase in gas prices is really painful to hear and he encourages Missouri.

25 cents in 2022 5 cents in 2023 75 cents in 2024 10 cents in 2025 and then 125 cents in 2026 and. There is a way for Missourians to get that increased tax money back though. Instructions for completing form.

Latest Missouri gas tax plan includes rebates for drivers. By then the total gas tax including the hikes will be 295 cents per gallon. The tax refund only applied to the new 25 cents per gallon tax increase and not Missouris existing 17 cents per gallon gasoline tax.

In October of 2021 Missouri raised its statewide fuel tax by 25 cents to a total of 195 cents per gallon. Make sure to save your gas receipts to get reimbursed starting July 1 2022. Missourians will be eligible to receive their first refund on July 1 2022.

Becky Ruth chair of the House Transportation Committee. The tax commission will first issue rebates to taxpayers who received refunds via direct deposit then will send paper rebate checks. Missouris gas tax is 195 cents after the 25 cent increase in October 2021.

The news of this refundable gas tax has been widely reported. The tax will continue to increase 25 cents a year until it hits 295 cents in 2025. There is a way for Missourians to get a refund by submitting their receipts.

Form 4924 can be submitted at the same time as Form 4923. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. The state announced possible refunds of the 25 cents tax increase per gallon paid on gas.

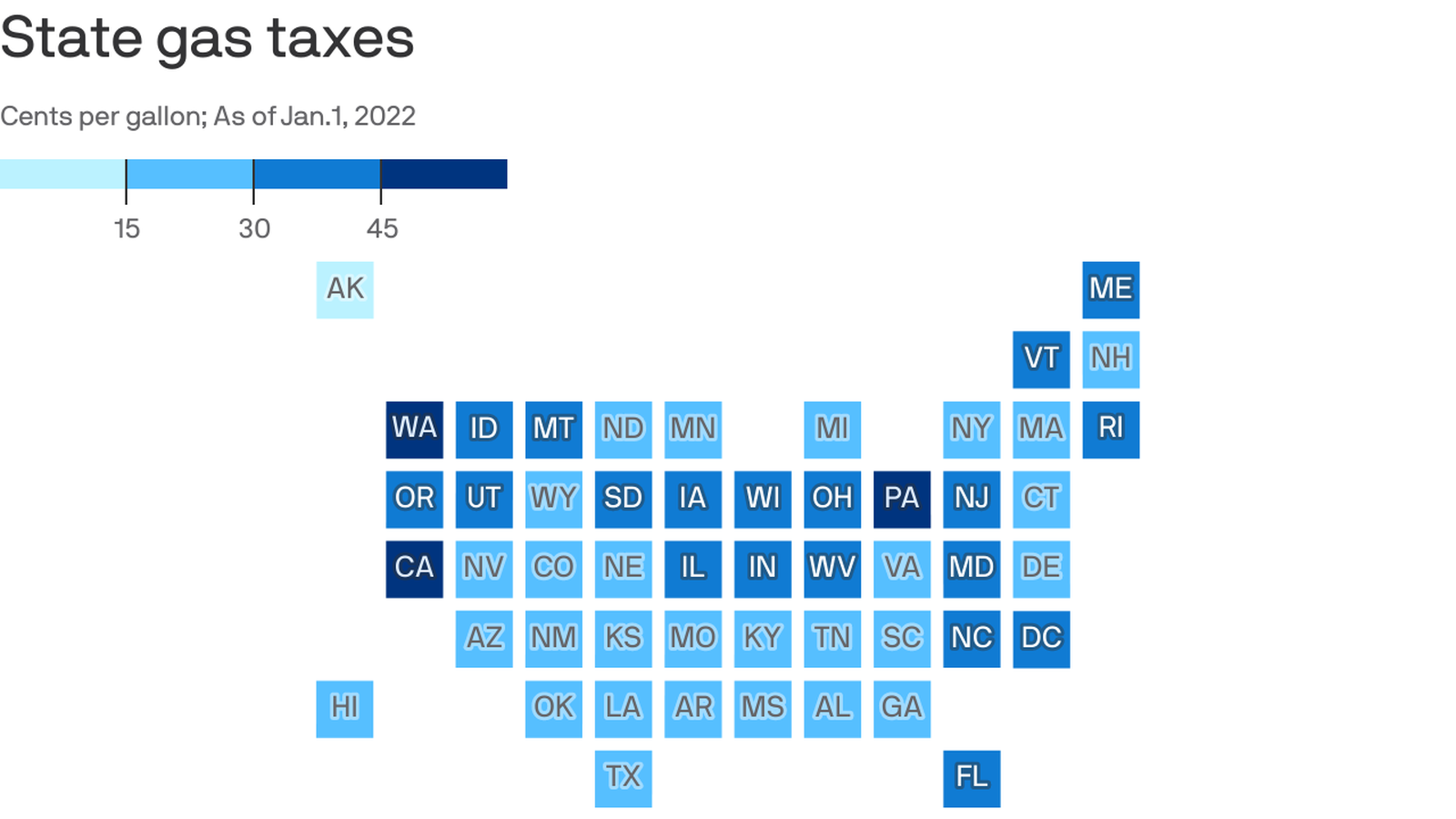

Vehicle weighs less than 26000 pounds. Form 4923 must be accompanied with a statement of Missouri fuel tax paid for non-highway use detailing the motor fuel purchased. The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon.

Instructions for completing form. Make sure to save your gas receipts to get reimbursed starting July 1 2022. Mike Parson in July raises the price Missouri drivers pay on gasoline by an additional 25 cents per gallon every year until 2025 for a total of 125.

Refund claims can be submitted from July 1 2022 to Sept. In October Missouri increased its statewide fuel tax from 17 cents per gallon to 195 cents per gallon. This bill allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually.

The tax which was signed into law by Gov. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid.

On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. It will go up 25 cents every year through July of 2025 when the tax will be ten cents higher than it is now at 295 cents per gallon. It was the first time in 25 years the states gas tax increased.

Fuel bought on or after Oct. The gas tax will go up 25 cents every year for the next few years until the gas tax. It was the first gas tax hike in 25 years but it will keep increasing by 25 cents per gallon every year until 2025 according to Missouri Department of Revenue.

Missourians can request a refund of the Missouri motor fuel tax increase paid each year. 1 2021 the date Missouri most recently. Fridays increase will bring Missouris gas tax to 195 cents.

The Missouri DOR says that people who buy gas for highway use can submit a claim to refund the added 25 cents per gallon starting July 1st. For most Missouri drivers the tax is refundable. Once fully implemented the gas tax hike could generate more than 500 million annually for state county and city roads.

30 2022 on purchases made after Oct. 1 2021 through June 30 2022. In 2026 the refundable gas tax will raise gas.

Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City Claimant Mailing Address Phone Number Alternate State ZIP Code Fax Number - E-mail Address Avg Price Per Gal Gasoline See instructions The refund claim must be filed within one year of. State residents can also check the status of their rebate online.

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Gas Prices States With The Highest And Lowest Gas Taxes

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump Gobankingrates

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Tax Deductions Small Business Tax Deductions

Pennsylvania Bill Would Lower State Gas Tax Axios Philadelphia

5 Smart Ways To Use Your Tax Return Millennial In Debt Money Management Advice Money Saving Strategies Saving Money Quotes

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Missouri Fuel Tax Increase Goes Into Effect On October 1

Gas Tax Cut Again In Missouri Nextstl

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Missouri Gas Tax Refund Form 4925 Fill Online Printable Fillable Blank Pdffiller

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase